SPOILER ALERT!

How To Distinguish In Between An Excellent Public Insurers and A Bad Public Adjusters.

Content written by-Kjellerup Baxter

An Insurance Insurer, additionally called a Public Insurer, is generally a broker that is independent. You, the policyholder, are typically represented by an Insurance Representative. He or she serves entirely for your rate of interests and also has no stake in any insurance company. The insurance coverage company will normally appoint its own insurance claims adjusting representative to manage its rate of interests exclusively. Nonetheless occasionally there are specific instances where the cases adjuster from a huge firm is hired to serve the interests of the insurance company. They are usually hired to settle the insurance claims versus a specific or a tiny company.

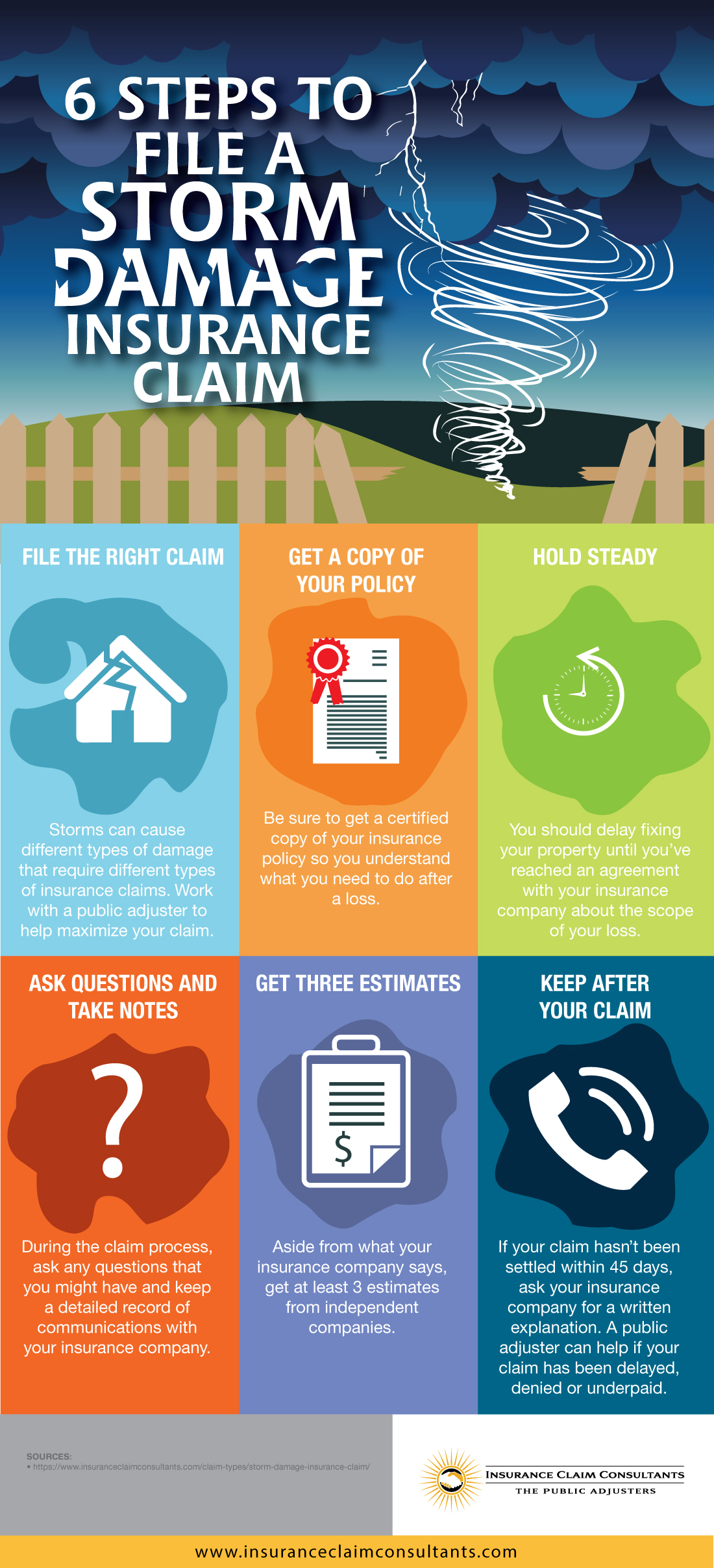

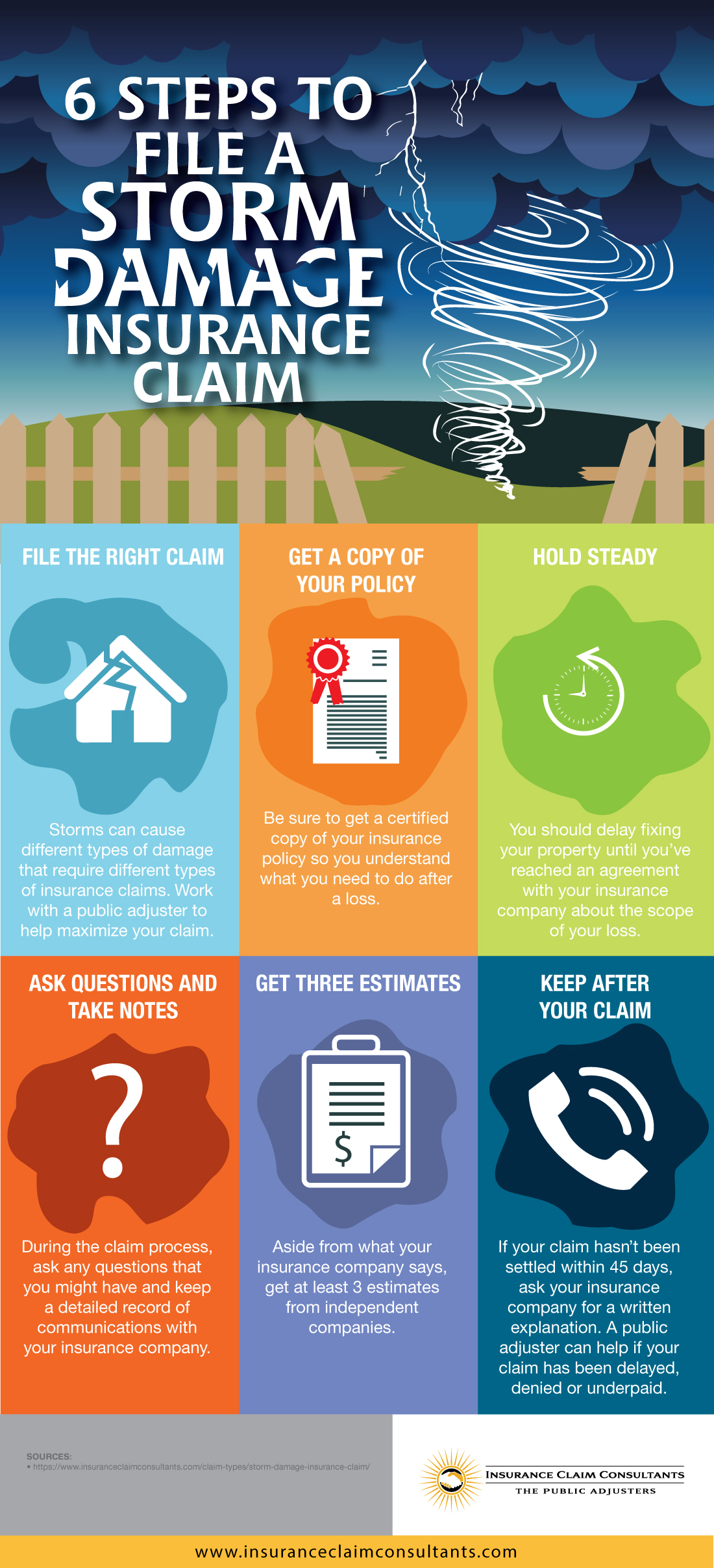

It is extremely vital that you have a great public insurance adjuster who can make the water damages remediation less complicated for you. A good public adjuster recognizes exactly how to manage the insurance companies. Insurance claims versus you ought to be handled quickly to lessen any kind of loss of time for you. In case you are discovering it tough to deal with your claim be guaranteed that a good public insurer will certainly be useful. He will have the necessary experience and expertise to deal with the cases efficiently.

There are specific rules and regulations that you need to comply with to make sure that your case is worked out in a quick and proper way. A good public adjuster has understanding regarding these regulations and laws. It is not wise to try negotiation by yourself considering that there is constantly a possibility that you might make a mistake or provide false details to the firm adjuster. It is best to hand over this task to a reliable company insurer who recognizes with these treatments.

The most integral part of the settlement procedure is the evaluation of the harmed home. When view it now hand over the obligation of taking care of your insurance provider, they will probably wish to see your residence and also check the damage to make certain that you are making an insurance claim for the appropriate problems. If there is damage to the house, the insured party will be reliant pay for these repair work. Insurance provider usually favor to take care of individuals who are proactive when it involves submitting insurance cases and helping them recoup their cash.

Insurer often tend to prefer employing a public insurer because he or she has much more experience in this area than an agent does. https://www.prnewswire.com/news-releases/global-access-control-market-2020-to-2025---rapid-urbanization-in-emerging-countries-presents-opportunities-301125108.html recognize just how to deal with all the paperwork involved in the cases process. The insurance provider can likewise appoint this person to deal with any other cases that you might have.

When you employ a public insurer, there are some things that you need to be familiar with. Most notably, you need to divulge the nature of the claim before the insurance adjuster does his work. Insurance companies favor that you educate them concerning the nature of your claim when you begin making arrangements. This will make certain that they do not lose time in contacting you for info pertaining to the case and also your willingness to pay a reduced fee.

If the company needs to do any type of examination on your behalf, it would cost you even more money and also postpone the process. You should additionally bear in mind that the public adjuster will not help you with legal guidance. This is the duty of your attorney or various other insurance claims representative. The public insurance adjuster's task is restricted to collecting details and submitting it to the insurance coverage agent or your lawyer. You can not anticipate the public insurer to ask you any concerns that connect to your instance.

If you have made an insurance claim before as well as you are still not satisfied with the outcome, it is very important that you need to let the general public adjuster know. This will certainly allow the insurance company to make any type of adjustments that they require to before the next insurance claim. In most cases, your claim was denied but it might end up with an adjustment as a result of the bad experience that you have had with the business. It is your right as an insurance policy holder to have a great public insurer.

An Insurance Insurer, additionally called a Public Insurer, is generally a broker that is independent. You, the policyholder, are typically represented by an Insurance Representative. He or she serves entirely for your rate of interests and also has no stake in any insurance company. The insurance coverage company will normally appoint its own insurance claims adjusting representative to manage its rate of interests exclusively. Nonetheless occasionally there are specific instances where the cases adjuster from a huge firm is hired to serve the interests of the insurance company. They are usually hired to settle the insurance claims versus a specific or a tiny company.

It is extremely vital that you have a great public insurance adjuster who can make the water damages remediation less complicated for you. A good public adjuster recognizes exactly how to manage the insurance companies. Insurance claims versus you ought to be handled quickly to lessen any kind of loss of time for you. In case you are discovering it tough to deal with your claim be guaranteed that a good public insurer will certainly be useful. He will have the necessary experience and expertise to deal with the cases efficiently.

There are specific rules and regulations that you need to comply with to make sure that your case is worked out in a quick and proper way. A good public adjuster has understanding regarding these regulations and laws. It is not wise to try negotiation by yourself considering that there is constantly a possibility that you might make a mistake or provide false details to the firm adjuster. It is best to hand over this task to a reliable company insurer who recognizes with these treatments.

The most integral part of the settlement procedure is the evaluation of the harmed home. When view it now hand over the obligation of taking care of your insurance provider, they will probably wish to see your residence and also check the damage to make certain that you are making an insurance claim for the appropriate problems. If there is damage to the house, the insured party will be reliant pay for these repair work. Insurance provider usually favor to take care of individuals who are proactive when it involves submitting insurance cases and helping them recoup their cash.

Insurer often tend to prefer employing a public insurer because he or she has much more experience in this area than an agent does. https://www.prnewswire.com/news-releases/global-access-control-market-2020-to-2025---rapid-urbanization-in-emerging-countries-presents-opportunities-301125108.html recognize just how to deal with all the paperwork involved in the cases process. The insurance provider can likewise appoint this person to deal with any other cases that you might have.

When you employ a public insurer, there are some things that you need to be familiar with. Most notably, you need to divulge the nature of the claim before the insurance adjuster does his work. Insurance companies favor that you educate them concerning the nature of your claim when you begin making arrangements. This will make certain that they do not lose time in contacting you for info pertaining to the case and also your willingness to pay a reduced fee.

If the company needs to do any type of examination on your behalf, it would cost you even more money and also postpone the process. You should additionally bear in mind that the public adjuster will not help you with legal guidance. This is the duty of your attorney or various other insurance claims representative. The public insurance adjuster's task is restricted to collecting details and submitting it to the insurance coverage agent or your lawyer. You can not anticipate the public insurer to ask you any concerns that connect to your instance.

If you have made an insurance claim before as well as you are still not satisfied with the outcome, it is very important that you need to let the general public adjuster know. This will certainly allow the insurance company to make any type of adjustments that they require to before the next insurance claim. In most cases, your claim was denied but it might end up with an adjustment as a result of the bad experience that you have had with the business. It is your right as an insurance policy holder to have a great public insurer.